10 Steps to Making a Profit Buying and Selling Websites

How do you go about buying and selling websites?

Website Broker – Ryan Sorensen answers these questions and more in…

Creating a Profitable Buying and Selling Websites Business

Just like other investments such as real estate, equities, or brick and mortar businesses, there is significant upside to selling online businesses.

However, with upside also comes risk!

In experience gained flipping my own sites and working as a broker at Flipping Enterprises (I completed $1.3m in deals in 2012), when sales are done correctly, you could be rewarded handsomely and mitigate many of these risks. I’m going to go over a 10-step plan on how you can buy and sell your first website profitably and relatively safely.

To get in the right mindset, think about buying and selling online businesses as you would with flipping houses. A smart house flipper looks to purchase an undervalued property which can be improved at minimal costs that they’ll be able to sell for a profit after a certain amount of time. Simply put, there are people who make a full-time living closing only 4 to 5 such deals per year. One of the differences between short term house flipping and website flipping is that you’ll have the opportunity to not only make money upon selling your website, but add a monthly profit stream in the meantime.

Would You Like Our Help To Sell Your Online Business?

Selling a business is one of the most important financial decisions you will make. Don’t get it wrong! If you own an eCommerce, Amazon FBA, SaaS & Technology, Service Based, Adsense, Affiliate, digital products or content-based business and are considering selling or just want a valuation, our recommended website broker team can help: Claim Your Free Website Valuation & Exit Strategy Today

Selling a business is one of the most important financial decisions you will make. Don’t get it wrong! If you own an eCommerce, Amazon FBA, SaaS & Technology, Service Based, Adsense, Affiliate, digital products or content-based business and are considering selling or just want a valuation, our recommended website broker team can help: Claim Your Free Website Valuation & Exit Strategy Today

+++++++++++++++

10 steps to Making a Profit Buying and Selling Websites

=> Enjoy these 10 steps and most importantly, take action!

1. Know your limits

- Money

- Time

You have to be honest with yourself. How much money can you afford to lose? Really think about it. If you lost that $5,000 that you are planning on investing, could you survive? No investment is guaranteed no matter how attractive it is. You need to prepare by knowing how much money you are able to put in. Once you have that number, think about how much time you can commit to managing a new business. While many websites are passive in nature, there are things you will need to be doing in order to increase its value. Prepare to spend some time gaining the knowledge or skills necessary to work on your new acquisition.

2. Know what sites will grow

A term you may have heard before is “evergreen” niches. This type of niche does not have an obvious expiration date and is fueled by constant human needs and wants. Examples include car insurance, consumer electronics, clothing, sports, business, beauty and health, etc. Keeping lifecycle dates in mind on websites you may be interested in is critical. If you buy a site that makes money on something that will soon become illegal due to recent passed legislation, or that is based on a fad, you may find yourself out of pocket.

A positive reason for buying an established site, no matter how competitive the niche, is that it has a history of performance to measure from. If it has made $1,000 a month in profit from search engines, you’ll know what keywords it’s ranking for and where it can be scaled. You’ll also see what revenue sources its used and what quick chances can be made to increase profit instantly (negotiating better affiliate payouts, optimizing ad placements, increasing conversions in sales funnels, etc.). Just as a house flipper looks for simple fixes and improvements like replacing the carpet, painting, and renovating the kitchen, you should be looking for websites that can be improved on and scaled up.

Also, find those that align with your interests. It will help keep you motivated when things get tough. Here’s a basic checklist:

- Evergreen niches

- Upside potential

- Aligns with your interests

3. Where to find websites for sale

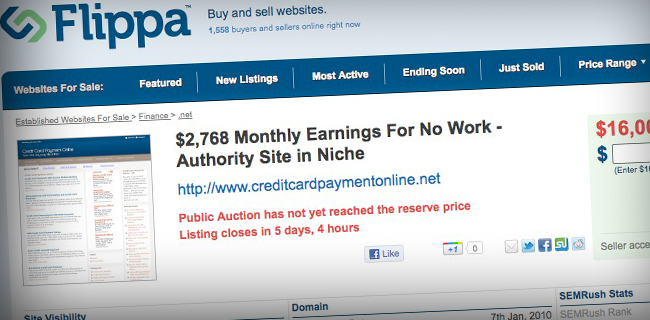

As some of you may have seen, the quality of sites for sale can sometimes be very poor. Wading through it all is a part of the process, and something to remember for most cases, you get what you pay for. Don’t expect to be able to buy a quality $5,000 a month profit earner for only $15,000 (3x monthly multiple) – it can happen when a site is still in its beginning stages and unproven, but it isn’t the norm. Generally speaking, a good range to be in as a buyer is 12-18x the monthly profit average for a relatively small site (<$50,000). If it’s making $1,000 a month, an asking price of $12,000 to $18,000 is reasonable. However, each listing and its seller is unique, and great deals can still be made, especially if you can spot growth opportunities. Below are some of the most popular places to find websites for sale:

- Website brokers (FlippingEnterprises.com, Wesellyoursite.com, etc.)

- Website marketplaces (Flippa.com, Bizbuysell.com, WebsiteBroker.com, etc.)

- Forum marketplaces (Experienced-People.net, Warriorforum.com “websites for sale” section, Digital Point forums, etc.)

- Directly from buyer (Google search and email contact or people you know)

Do You Buy Websites?

Join Our Website Buyers List

Whether you’re looking for a Blog, content-based business, eCommerce, Amazon FBA, Adsense or Affiliate website we have exclusive opportunities not found anywhere else!

4. How to conduct quick due diligence

As a general guideline, use the following questions for each listing that you are interested in as a quick “rejection” filter:

- Why are they selling it? Common red flags are dying niches, borderline products/services, such as phone unlocking or movie downloads, and recent Google update hits (losing traffic from Google updates can be recoverable and present a unique opportunity for those with the available skills and resources).

- Do they provide proof of revenue and traffic? Look for screenshots of revenue that show the website URL or evidence it comes from the claimed source and traffic analytics from a trusted platform like Google analytics.

- Can you trust the seller? Take a quick look at their account feedback and history and do a Google search on their name and look at least 2 pages of results.

5. How to conduct thorough due diligence

If a site passes the first test and you’d like to dig deeper, most sellers will be willing to send you specific details. Take a deeper look at:

- Traffic analytics. Are there any periods where traffic was down? Are their traffic sources well distributed rather than relying too heavily on one source? Have a look at their referring sites. Are any of those owned by the seller and will the links remain in place after the sale?

- Revenue proof. If needed, ask the seller to provide a video of them logging into their affiliate or merchant accounts and prove it is coming from the claimed URL or associated account. For example, get the “URL channel” reports for Google Adsense.

- Speak to the seller. One of the best ways to gain trust is by speaking to the seller on the phone or on Skype. It will not only help you get a feel for who they are, it will increase the chances they’ll be willing to work with you on the price when it comes time to make an offer.

- Speak to a professional. If you are unsure how to proceed or are not confident with the process, speak to a third party. Many brokers are willing to offer “buy-side” services and help with due diligence. A third party can help remove any emotion from the deal.

6. Making the right offer

If you feel that this is the right website for you, it’s time to make an offer. The key is to start with your lowest offer but to make it high enough to get the sellers attention. If they are asking $10k and that’s an 18x monthly profit multiple, offering only $2k will most likely get you nothing but an annoyed rejection email. 70% of the asking price is a good starting point.

Giving reasons for why you are offering a lower amount by highlighting some of the website’s negatives can help your cause. Also having the cash and being able to prove it, and helping the seller trust that you’ll take good care of the site are ways to sway them to pick you over someone else, even if your offer is lower.

To give you that edge going into making an offer, study this informative rundown on how to negotiate effectively, published by Inc. magazine.

7. You own the site, now what?

The short answer to this questions is, get to work! The more you increase monthly profit, the more it will be worth once you decide to sell. Literally thousands of articles have been written on the subject of building traffic and monetizing websites, a few of the better ones can be found on Income Diary here and here, respectively.

If you don’t have the time, resources, or energy to do the work yourself, be sure that who you hire has good references/feedback and isn’t overcharging. You may be able to increase your bottom line just by finding more affordable help, but just be sure you aren’t sacrificing quality – SEO (search engine optimization) work, customer service, and sales reps are good example here.

Another key point is to automate and systemize the website where you can. A site that takes an owner only 5 hours a week to conduct basic maintenance will sell for more than one taking 20 hours a week.

8. Making the decision to sell

If your website is attractive enough – steady or increasing traffic and earnings in a solid niche – it will most likely sell for more than what you paid for it, even if you’ve only owned it for a month. Ask yourself the following questions to determine if it’s the right time to sell for you:

- Have you exhausted all possible ways to optimize traffic and earnings? This is the reason many sellers decide it’s time to let go. But don’t feel bad, buyers may see opportunities to expand that you don’t.

- What percentage of your investment has already been returned? Will you make a positive return on your investment if you sell now?

- What will you do with the sale proceeds? If you are selling to invest into a different website or project, stop and think about it for a minute. How likely is this new website of project to earn more money? Is it worth taking a potential hit on price by not waiting longer to sell – for example if you have a few down months or if it’s during the typically slower season for buyers during the summer?

If you need to sell it due to the website’s poor performance from a Google update, sudden change in available monetization options, etc. and you need to cut your losses, our suggestion is to do what you can to stabilize it or put it up for sale in time for someone else to stabilize it and hopefully grow it. Once the revenue hits zero the value follows.

9. How to sell it

This is the best part! Selling a website works in the same way you would sell any other product online – it needs to be put it in front of your most targeted audience. You’ll find the most qualified buyers in the same places you went to purchase a site, through brokers, marketplaces, directly, and in industry forums. Key points to remember:

- Be prepared by keeping detailed records of traffic and income (Google analytics, monthly profit/loss statement, access to reports from affiliate networks or merchant accounts, etc.)

- Be upfront and honest and available to help with due diligence questions. Most buyers just want to get a clear picture of the past performance and more importantly, that they can trust you.

- Don’t be greedy. Unless you have the time and patience to wait for someone to jump up to your unrealistic asking price, it’s best to stick to the “sweet spot” which is where both buyer and seller feel it’s fair. 12x to 24x monthly profit multiples is a good range to be in. If you are unsure, do a quick search on what similar sites have sold for on website brokers “sold listings” pages or Flippa.

Brokers specialize in selling listings for fair prices and in reasonable amounts of time for a success fee. Most will give you a free valuation and advice on how to either sell it yourself if they can’t take it on, or how to increase its value.

If you venture on your own by listing in one of the marketplaces be sure to filter out scammers by always using an escrow service (we suggest escrow.com), review their feedback and past activity, and speak with them on the phone or Skype prior to accepting their bids.

10. Rinse and repeat

Pay into the “University of Life” as my Mom used to say, by taking action and keeping notes. Then, take the advice of many a successful internet marketer – once you have a system that works, repeat it! If you do end up losing some money on your first deal, don’t give up. You’ll have more confidence and experience to try again and hopefully make a profit.

Conclusion

A colleague of mine bought a site for $2500 that was making $200-$300 a month in profit. He changed how it was monetized and brought it to over $2000 a month, without doing anything to the existing traffic. 3 months later he sold it for $25,000 for a profit of almost $30,000.

While this is one of the more successful website flips that I personally know on a percentage increase basis, it’s not that uncommon to find. Just like traditional real estate, established quality websites and domains will increase in value over the long term.

If you have any questions about the process of buying and selling websites, feel free to ask me in the comments. If interested in our website brokerage services, please visit flippingenterprises.com.

Thanks for your time!

Are you considering selling your online business?

=> Claim Your Free Website Valuation & Exit Strategy Today

=> Related: Sell A Website For Top Money

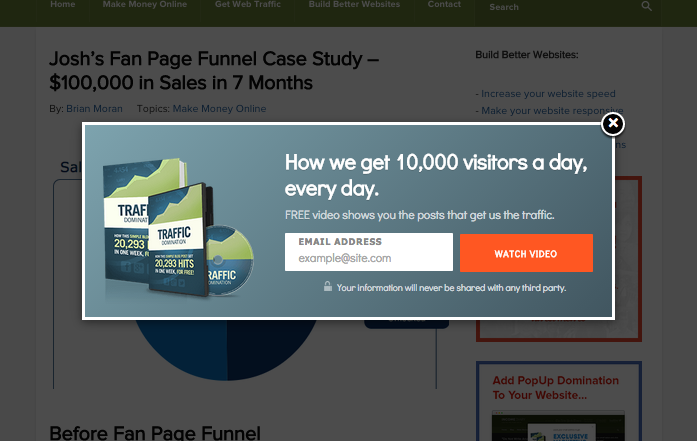

"Do Not Write Another Blog Post Until You Watch This Free Video..."

Watch this free video to learn...

- How I got over 10,000,000 people to visit my websites.

- The types of blog post that got me all that traffic.

- How to get someone else to do it for you!

Good post but the only reason why I would sell a site is if it was taking up too much of my time and I wasn’t happy with my income from it.

Why sell a real asset when you could keep it?

Thanks for the comment Darnell. Some of the main reasons why people sell steady earning or growing sites are 1. they have a financial emergency like a medical bill, owing back taxes, death in the family, etc., 2. if there are still some daily time requirements and they can’t stand being in the niche any longer, 3. if they suspect that the niche will no longer be as strong within say the next 6 months to a year, and 4. they may be regular site flippers and want to sell when the site is performing well.

There are other personal reasons as well. But otherwise you’ll find that people who have built their sites from the ground up are the hardest to persuade to get rid of them, even with very competitive offers.

I agree with you Darnell. Perhaps we could be better of by buying these web properties then. Some website owners do not realize how to take their sites to their full potential so they end up selling it for quick profits. There are a lot out there. The hard part is taking the proper steps in order to look for the best deals.

I’ve thought about buying and selling site in the past, but it seems too easy for someone to fake the traffic and/or sales stats. However, you do offer some good ideas for confirming the info. that’s given.

How about buying and selling domain names??

Hi Joseph, thanks for the question.

Consider domains to be like owning empty plots of land. A piece of land that is within a commercial zoning area, next to high traffic areas like a highway off ramp, next to down town, good views, etc. will not only command a high price in comparison to other land without these qualities, it will go up in value over time as the supply decreases.

Similarly, a domain that is generic, intuitive, easy to remember and/or can be turned into a brand, and based on competitive money making niches like insurance, beauty, fitness, etc. are in short supply and will continue to go up in value. Examples include incomediary.com (Michael has built a brand on this domain and readers know they can expect quality, helpful content), hulu.com, autoinsurance.com, basketball-equipment.com, etc.

Plots of land by themselves aren’t always as valuable as an income producing structure like apartments, commercial and retail buildings.

I suggest not only investing in domains but consider how they can be turned into income producing web properties.

Good question Michael. Two things that will most impact the asking price when they decide to sell:

1. Increasing traffic and income every month if at all possible, but in the very least keeping it level. Buyers will pay more for a site they believe to be healthy. Expect a site to sell for less if it’s been recently hit by a Google update or if earnings are down due to switching affiliate programs, changing product lines, etc.

2. Automating it. If you are spending 15 hours a week writing content yourself and updating your social media pages, don’t expect the buyer to be as excited and willing to pay premium for a site that they’ll have to run as a part-time job versus one that has hired writers or content produced by guest posters. Look into also hiring out quality SEO work and other traffic campaigns. Buyers are willing to spend more for less maintenance time.